Implications Of An Inverted Yield Curve For U.S. Bond Returns

Matt Brill & Todd Schomberg, Invesco

Source: https://www.invesco.com/us/en/insights/implications-inverted-yield-curve-us-bond-returns.html

Summary

The US Treasury market is the world's largest and most liquid government bond market.

The shape of the Treasury yield curve provides insights into investor sentiment regarding monetary policy, risk, and the economy's direction.

Typically, the yield curve is upward-sloping, with longer-term bonds offering higher yields than shorter-term bonds.

However, there are occasions when the yield curve inverts, with short-term rates surpassing long-term rates.

An inverted yield curve is considered a strong signal that an economic recession may be imminent.

Inverted yield curves have preceded recessions, except for the COVID-induced event in 2020, with an average lead time of about a year.

During recessions, investors tend to shift from riskier assets to safer instruments like bonds.

Lower growth and inflation expectations during recessions lead to reduced interest rates, which support bond markets.

Increased demand for bonds during recessions creates a cycle of price appreciation and further demand.

Historical data shows that corporate bond returns tend to be positive in the year following the peak of a yield curve inversion during past recessions.

The pattern of increased corporate bond returns after peak yield curve inversions is consistent across different historical periods.

Original Article

The US Treasury market is the largest and most liquid government bond market in the world. The shape of the Treasury yield curve provides valuable information about how investors view monetary policy, risk and the direction of the economy.

Normally the yield curve is upward-sloping with longer maturity bonds offering a yield premium to shorter-dated bonds. However, occasionally the yield curve inverts, and short-term rates exceed longer term rates.

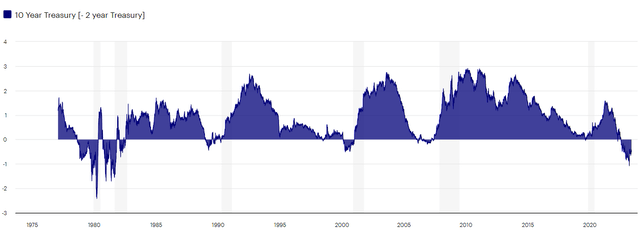

An inverted yield curve is viewed as a strong signal the economy may be heading for a recession. A yield curve inversion has preceded every recession since the 1970s — other than the COVID-driven event in 2020 — by about a year.

An inverted yield curve has been a historical indicator of recessions

Source: Macrobond. Inverted yield curve represented by the spread between the 10-year US Treasury yield and the 2-year US Treasury yield. Grey bars highlight periods of recession. An investment cannot be made in an index. Past performance is not a guarantee of future results.

During a recession, investors tend to reduce allocation to riskier assets and shift into instruments like bonds. A recession decreases growth and inflation expectations leading to lower interest rates, which further support bond markets. As more investors move into bonds, demand for bonds creates a virtuous cycle of price appreciation and even more demand. This pattern is consistently observed in corporate bond returns for the year following “peak” yield curve inversion during past recessions.

Corporate returns after peak inversion

2s/10s InversionPeak InversionAmount of Inversion at peakCorporate Index Returns 12-months after peakAug 1978 – May 1980Mar 20, 1980-2.4213.22%Sept 1980 – Nov 1981Dec 17, 1980-1.712.95%Jan 1982 – July 1982Feb 18, 1982-0.7241.31%Dec 1988 – Oct 1989Mar 29, 1989-0.4411.79%Feb 2000 – Dec 2000Apr 7, 2000-0.5112.79%Dec 2005 – June 2007Nov 27, 2006-0.193.44%

Source: Macrobond. 2s/10s Inversion is when the yield on the 2-year Treasury exceeds the yield on the 10-year treasury. The corporate index shown is the Bloomberg US Corporate Bond Index. Returns are calculated monthly in the 12-month period following the point of peak inversion. An investment cannot be made in an index. Past performance is not a guarantee of future results.